RISK MANAGEMENT / ACTUARIES

Presentation

Due to its experience along major insurance, banking and financial companies, Nexialog has built its risk management offer on big regulatory and transformation projects. The implementation of Basle and Solvency regulations involves an accurate management and estimation of inner risk parameters to get an optimal use of equity capital.

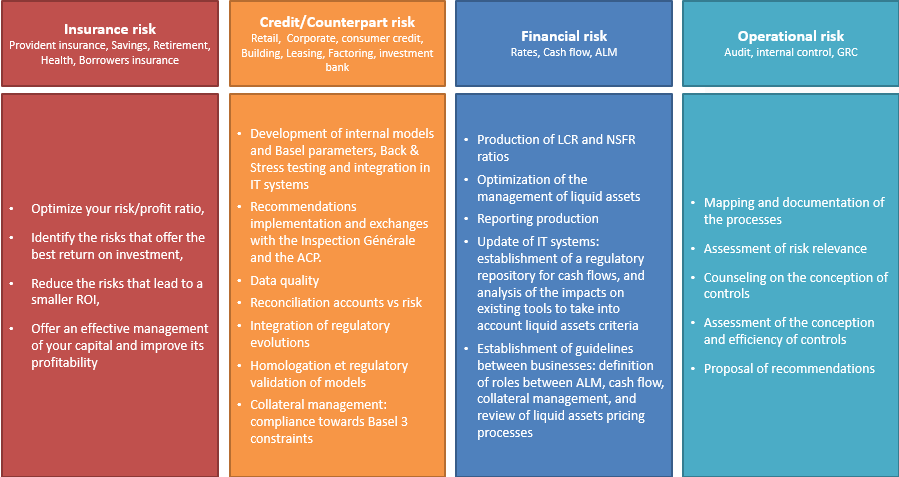

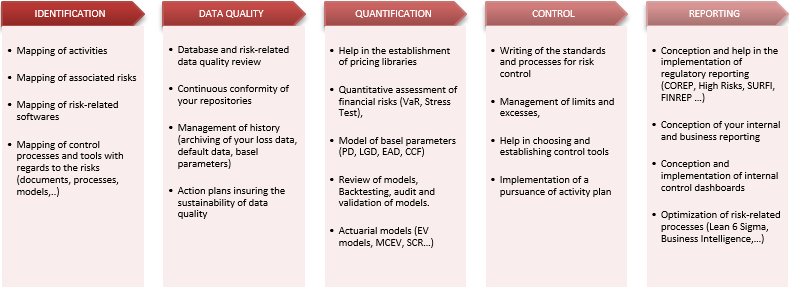

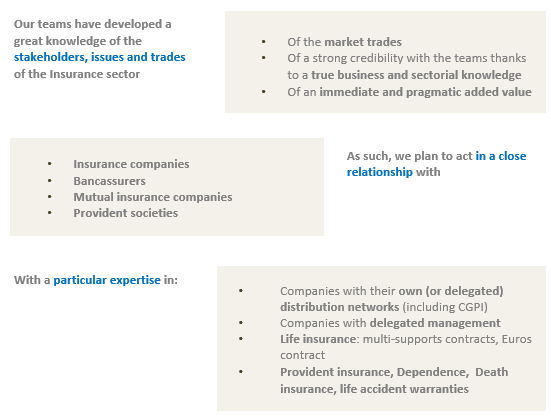

Scope of the intervention

The center of our expertise lies in the knowledge of quantitative analysis, and the permanent follow-up of new regulations, with which we are matching our project management methodology.

Our approach

Linked to the inner organization of Nexialog, the risk management offer allows the consultants to rely on their managers who are experts in their particular fields. It also helps them extend their area of intervention.

References

Development of the internal model of a life insurance company.

Context : Following the different regulatory adjustments (Solvency 2, IFRS), the financial direction wishes to have its own model of equity capital demand calculation.

Scope of intervention : savings contracts of collective provident societies/borrower, full life contracts

Intervention :- Calculation of the regulatory equity capital demand: Model of collective/borrowing provident societies, savings, ERC, L441 products and calculation of projected SCR (PILLAR 2, ORSA).

- Strategy: optimization of asset allocation strategy, analysis of profitability factors, help with new products development, evaluation of new acquisitions.

- Management/Risks: Study and follow-up of technical, financial and operational risks. Setting up of gains/risks ratio optimization programs.

Management of the reliability of weighting applied to the real-estate portfolio of a French bank

Context : The Basel II regulatory framework requires an internal control of risk measures and calculation of equity capital demands. On its real estate portfolio, the risk Management changes its risk valuation procedures on the following operations: determination and valuation of guarantees and application of weights in the standard method.

Intervention :- Weights are put under control

- Supporting the deployment of prudential reporting evolutions on the real-estate portfolio

- Evolution of the operational watch on the real-estate perimeter

Data quality project – IRBA approval project of a French bank

Context : The approval project aims at moving all of the credit risk models into IRBA, which means in an advanced notation system. In this approval project, banks have to make sure of data quality ahead of the Basel parameter modeling. What is at stake is to confirm the consistency between data coming from front applications (accounting application, commercial application…) and data coming from the risk information tool.

Intervention :- Measuring and analyzing the spreads between the management tools and the risk tools.

- Proposing an approach to correct and improve the data feeding process.

- Controlling the consistency of the data in all the Information System.

- Giving the most consistent data to the teams responsible for the notation.

OPERATIONAL STRATEGY

Presentation

Banks, insurance companies and mutual funds have to cope with important changes where strategic choices are complex and where success depends on the organizational strategy, on the teams’ coordination and on the Information Systems harmonization.

We are helping you realize your projects on each and every level from the first thought to the final implementation :

- We accompany you in your strategic projects

- With our strong professional knowledge, we know how to develop and implement strategic decisions

- We also master activities which contribute to you’re the success of your company’s projects

Our focus areas

We work with the whole insurance value chain, with specific know-how in four particular areas :

- Operational efficiency

- Improvement of management quality by a better allocation of resources and an adjusted organization to tackle the most relevant special features (product lines, customer segmentation, delivery channels, operations management…)

- Optimization of the customer portfolio by decreasing the fall rates, a better product profitability, an anticipation of the ageing of the product portfolio, an optimization of the creation and of the marketing process

- Support in the strategic choice of scale management by choosing an externalization of the management, a new management application, the consistency of the product line and of the impact of new products

- Operational risks and compliance

- Diagnosis of operational risks and implementation of practical and preventive solutions to reduce and control risks (customers’ risks, financial risks, reputation risks), which is done by increasing the operational efficiency as regards customer commitments.

- Customer satisfaction

- Improvement of the quality of service and of the commitment for the final or intermediary customer through the definition and the implementation of a proactive management of contracts/a client-based management

- Improvement of client data processing through data securisation and the optimization of desktop publishing through the implementation of dematerialization systems

- Product quality

- Support in designing/renovating, product launch until it’s put on the market, and definition of its management

References

Management of a project entitled “Catégories Objectives” in a social protection group

Context : The decree of January 9th, 2012 related to the collective and mandatory characteristics of complementary social protection guarantees greatly affects social protection actors regarding management, commercial, computer science and legal matters. The implementation calendar of the June 14th 2013 “Sécurisation de l’emploi” law (January 11th, 2013 ANI transposition) emphasizes the need for quick action in this field.

Intervention :- Governance and management of the project : definition of theproject scope, roadmap, subdivision of the project, governance authority organization.

- Definition and implementation of the compliance strategy: contracts compliance, SI compliance, documents compliance.

- Impacts analysis: impacts on the tools, on the contractual documentation, on the margin and on the pricing of customized products.

- Change management: teaching the decree and the circular to the different contributors, defining the specific processes.

Management of a health pricing revision project, within a social protection group

Context : Periodically (e.g,. every year), health insurance organisms have to take into account the increase in prices as regards the covering of medical costs. Consequently, they have to increase customer premiums for the different type of contracts they have subscribed to.

Apart from the hike in the prices of medical and social services, the pricing revision can also be affected by possible new decrees of the “Financement de la Sécurité Sociale” law (LFSS). They can modify the pick-up charge level or the value of social and fiscal taxes which apply to the concerned insurance contracts.

- Project composition phase and implementation of the project governance.

- Impact study of related subjects (e.g., LFSS, development of SI management): making sure of the coordination with the pricing revision project.

- Operational management of the pricing revision and process optimization.

- Formalizing the targeted process to provide durability.

Dematerialization project of a financial company

Context : As part of an update of its channel network project, a financial company wishes to deploy an electronic management of documents (GED) in order to reduce the timeouts, to improve the management quality and to secure its activity. This project is also used to lead a reflection on the implementation of a CRM tool for the middle offices as well as on the reorganization of back offices.

Intervention :- Functional report of the pilot project and description of the IT solution.

- Process : Design of the targeted operational mode of the pilot.

- Organization: description of the implementation strategy for the whole project.

- Tools/equipments: technical specification of the pilot and of the equipment needs (equipment, setup and ergonomics of the work station…).

- IT : support in the design of the solution

- Design of the extension package (communication plan, communication support and teaching, work station coaching, logistics)

ACCOUNTING / FINANCES

Presentation

The continuous evolution of the law and of the tools led to more and more complexity in the past few years, which underlined the strategic place of Financial Management. This distinctive trend forced a necessary evolution toward bigger transparency and a better quality of production.

Your constraints :- Optimizing the production and the quality of accounting and financial processes

- Developing flexibility and securing the accounting and financial information systems towards inner and outer constraints

- Improving the quality and the transparency of financial communication

- Answering the compliance demands

Beyond their historical functional purpose (the production of legal reports), financial management has seen its targets become more characterized by cross-disciplinary tasks, and going over inner service divisions (mastery of accounting and financial IT, internal control).

Thus, the methodological problem induced by these new cross-disciplinary goals is to adapt an organization which is traditionally based on a functional logic.

Nexialog supports its customers in mastering these new stakes by managing their transformation projects and by optimizing their processes.

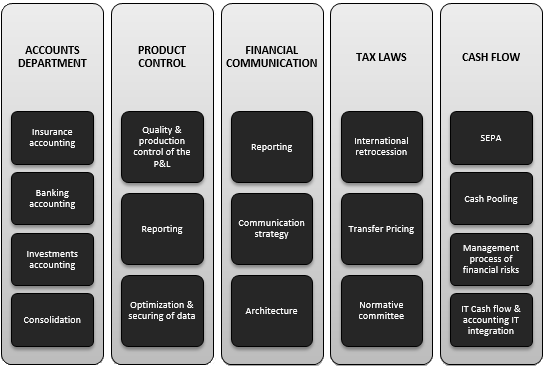

Our focus areas

Our approach

Nexialog’s goal is to bring you our knowledge, through the tuning of our methodological know-how to optimize your processes.

Our added value is based on two axes :

- Aligning/Optimizing your processes

- Supporting the business as well as the accounting and financial projects

References

Study of forecasted financial production – Investment management of a French insurance company

Context : The investment management is producing reports on the real and forecasted asset financial production every month, in French and IFRS standards. The current process of the forecasted production is not perfect (long realization periods, handed reprocessing, non-homogeneous market hypothesis…). Because of this, the investment management decided to launch a study on the forecasted financial production rationalization. The aim is to audit the existing process and to propose a detailed targeted solution.

Intervention :- Definition of the extent and goals of the study.

- Deep analysis of the existing process.

- Production of an audit report which details the existing process, its assets and its improvement axis.

- Collection of new needs and construction of models.

- Definition of a targeted process which allows for the improvement of monthly production.

Deployment of a centralizing tool of cash flows for an insurance company

Context : An insurance company wishes to implement the same tool to manage the whole group’s cash flows globally and optimally. The change of the cash management tool aims at securing the transfers thanks to control measures. This project has been led in compliance with the SEPA regulations and the implementation of the unit payment SWIFT FIN.

Intervention :- Describing and formalizing the functional and technical existing process.

- Producing a report describing the strengths, the weaknesses, the opportunities and the threats related to the needed solution in terms of basic functionalities.

- Supporting the customer in determining the targeted process.

- Planning, organization and presentation of the tests with the cash management tool editor.

- Organizing the updated SCORE contracts with the banks.

Technical improvement and thinning of the processes for the overheads management tool of a French insurer

Context : As part of the Taskforce supporting the implementation of the Ariba tool, there is a review of the main problems encountered by the users on the Purchase to Pay process, in order to define the organizational and technical solutions. From the identified Quick Wins, interface between the users and the developers. Management of problems in BAU (business as usual) mode.

Intervention :- Organization: planning, organization and management of meetings, production of reports, Workshops organization, interface with the control management teams, audit support.

- Business tasks: Production of the specifications of needs (French and English), production of the general functional specifications, test reports, emission of the monthly management report, audit support.